(Amendment No. )

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive |

☐ |

Soliciting Material under Rule 14a-12 |

Capstead Mortgage Corporation

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. |

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) | Title of each class of securities to which transaction applies: |

(2) | Aggregate number of securities to which transaction applies: |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule |

(4) | Proposed maximum aggregate value of transaction: |

(5) | Total fee paid: |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) | Amount Previously Paid: |

(2) | Form, Schedule or Registration Statement No.: |

(3) | Filing Party: |

(4) | Date Filed: |

Notice of Annual Meeting of Stockholders

To Be Held May 25, 2016

To the stockholders of

CAPSTEAD MORTGAGE CORPORATION:

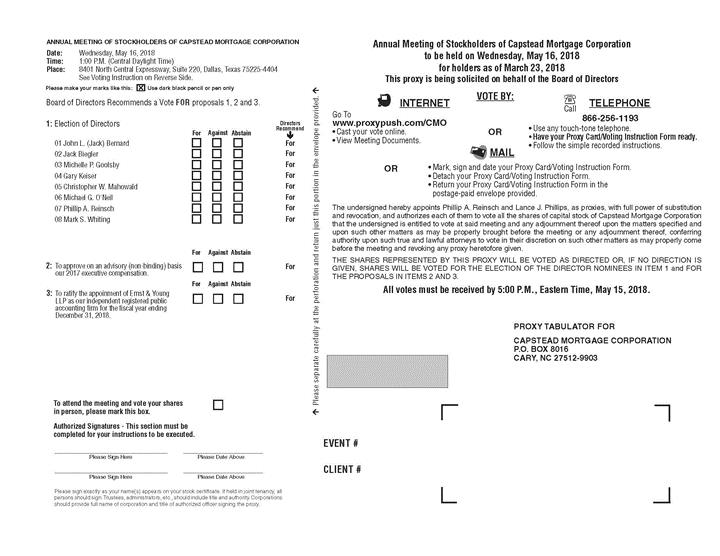

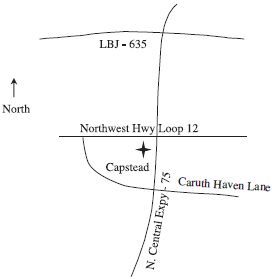

On behalf of our board of directors, I am pleased to invite you to attend the 20162018 Annual Meeting of Stockholders of Capstead Mortgage Corporation, a Maryland corporation, to be held at 8401 North Central Expressway, Suite 220, Dallas, Texas 75225-4404 on Wednesday, May 25, 201616, 2018 beginning at 1:00 p.m., Central Time, for the following purposes:

(1) | To elect eight directors to hold office until our next annual meeting of stockholders and until their successors are elected and |

(2) | To approve on an advisory (non-binding) basis our |

(3) |

To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, |

In the discretion of the proxies, our annual meeting may include the transacting of any other business that may properly come before the meeting or any adjournment of the meeting.

** PLEASE VOTE NOW ** | YOUR VOTE IS IMPORTANT | ** PLEASE VOTE NOW ** |

Stockholders of record at the close of business on March 23, 2018 will be entitled to notice of and to vote at our annual meeting of stockholders. It is important your shares are represented at our annual meeting regardless of the size of your holdings. Whether or not you plan to attend the meeting in person, please vote your shares as promptly as possible via the internet, by telephone, or by signing, dating and returning your proxy card. Voting promptly saves us the expense of a second mailing or telephone campaign and reduces the risk that the meeting is adjourned because of the lack of a quorum. Voting via the internet or by telephone helps reduce postage and proxy tabulation costs. See the “Voting” section of this proxy statement for a description of voting methods. Stockholders please note that New York Stock Exchange regulations require you to vote this proxy in order for your shares to be counted. Your broker will not have any discretion to vote your shares on your behalf for Proposals 1 and 2 without direction from you. | ||

PLEASE DO NOT MAIL YOUR PROXY CARD IF YOU VOTE BY INTERNET OR TELEPHONE.

By order of our board of directors,

Lance J. Phillips

Secretary

8401 North Central Expressway, Suite 800

Dallas, Texas 75225-4404

April 13, 2016

TABLE OF |

TABLE OF CONTENTS

1 |

| 17 | ||

1 |

| 17 | ||

2 |

| The Role of the Committee, Its Consultant, the CEO and | 18 | |

2 |

| |||

2 |

| 18 | ||

2 |

| 19 | ||

2 |

| 20 | ||

3 |

| 20 | ||

3 |

| 20 | ||

3 |

| 23 | ||

3 |

| 24 | ||

4 |

| 24 | ||

7 |

| 25 | ||

7 |

| 26 | ||

7 |

| 27 | ||

7 |

| 29 | ||

8 |

| 31 | ||

9 |

| 32 | ||

9 |

| 32 | ||

9 |

| 33 | ||

9 |

| 35 | ||

10 |

| 36 | ||

11 |

| 36 | ||

11 |

| Security Ownership of Management and Certain Beneficial Owners | 37 | |

12 |

| 37 | ||

12 |

| 38 | ||

12 |

| 38 | ||

13 |

| Proposal Two — Advisory (Non-Binding) Vote on Executive | 39 | |

13 |

| |||

Stockholder Procedures for Director Candidate | 14 |

| ||

| 40 | |||

Interested Party and Stockholder Communication with our Board | 14 |

| ||

14 |

| 41 | ||

Annual Board Evaluation and Individual Director Self- | 14 |

| 41 | |

| 41 | |||

15 |

| 42 | ||

16 |

|

|

| |

16 |

|

|

| |

16 |

|

|

| |

17 |

|

|

|

8401 North Central Expressway, Suite 800

Dallas, Texas 75225-4404

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 16, 2018

This proxy statement, together with the proxy, is solicited by and on behalf of the board of directors of Capstead Mortgage Corporation, a Maryland corporation, for use at our annual meeting of stockholders to be held on May 16, 2018 at 8401 North Central Expressway, Suite 220, Dallas, Texas beginning at 1:00 p.m., Central Time. Our board is requesting you to allow your shares to be represented and voted at our annual meeting by the proxies named on the proxy card. “We,” “our,” “us,” and “Capstead” each refers to Capstead Mortgage Corporation. A notice regarding the internet availability of this proxy statement and our 2017 annual report will first be mailed to stockholders on or about April 6, 2018. This proxy statement will be available on our website at that time. See the “Notice of | |

Certain statements in our proxy statement, other than purely historical information, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on current expectations and assumptions of management that are subject to risks and uncertainties that may cause actual results to differ materially from our expectations. Please see “Forward-Looking Statements” in the 2017 Annual Report for more information. |

Capstead | | 1 |

GENERAL INFORMATION ABOUT VOTING |

The enclosed proxy is solicited by and on behalf of our board. We will bear the expense of soliciting proxies for our annual meeting, including the mailing cost. In addition to solicitation by mail, our officers or a company of our designation may solicit proxies from our stockholders by telephone, e-mail, facsimile or personal interview. Our officers receive no additional compensation for such services.

We intend to request persons holding shares of our common sharesstock in their name or custody, or in the name of a nominee, to send a notice of internet availability of proxy materials to their principals and request authority for the execution of the proxies. We will reimburse such persons for their expense in doing so. We will also use the proxy solicitation services of Georgeson Inc. For such services, we will pay a fee that is not expected to exceed $6,500 plus out-of-pocket expenses.

entitled to vote for matters coming before our annual meeting. Only common stockholders of record at the close of business on March 28, 201623, 2018 are entitled to vote at the meeting or any adjournment of the meeting.

If you hold shares of our common stock in your own name as a holder of record, you may instruct the proxies to vote your shares through any of the following methods:

via the internet by logging on to www.eproxy.com/www.proxypush.com/cmo to gain access to the voting site and to authorize the proxies to vote your shares;

by calling our transfer agent Wells Fargoproxy tabulator at 1-800-560-1965(866) 256-1193 and following the prompts; or

by signing, dating and mailing the proxy card in the postage-paid envelope provided.

Our counsel has advised us these three voting methods are permitted under the corporate law of Maryland, the state in which we are incorporated.

The deadline for internet and telephone voting is 11:595:00 p.m., CentralEastern Time, on May 24, 2016.15, 2018. If you prefer, you may bring your proxy to our annual meeting to vote your shares in person.

If a broker, bank or other nominee holds shares of our common stock on your behalf, the voting instructions above do not apply to you. You will receive voting instructions from them.

A quorum will be present at our annual meeting if the holders of a majority of our outstanding shares of common stock are present, in person or by proxy. If you have returned valid voting instructions or if you hold your shares in your own name as a holder of record and attend the meeting in person with your proxy, your shares will be counted for the purpose of determining whether there is a quorum. If a quorum is not present, the meeting may be postponed or adjourned until a quorum has been obtained.

We have hired Mediant Communications to count all votes cast at our annual meeting. The affirmative vote of a majority of all the votes cast at the annual meeting is required to elect each nominee to our board (proposal 1), approve on an advisory (non-binding) basis our 20152017 executive compensation (proposal 2), approve the Capstead Mortgage Corporation Third Amended and Restated Incentive Bonus Plan (proposal 3), and ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 20162018 (proposal 4)3). Unless otherwise required by Maryland or other applicable law, the affirmative vote of a majority of all votes cast is also required to approve any other matter brought to a vote at the meeting.

routine matter, including (i) votes to elect our directors; (ii)directors (proposal 1), or votes regarding annual compensation; or (iii) votes adopting, extending, or amendingexecutive compensation plans (proposals 1, 2 and 3);(proposal 2) unless the brokers have received instructions from the beneficial owners of the shares. It is therefore important that you provide instructions to your broker so that your shares will be counted in these matters.

Brokers may vote at their discretion on all routine matters (i.e. the ratification of the appointment of our independent registered public accounting firm)firm (proposal 3)). Broker non-votes occur when a broker, bank or other nominee holding shares on your behalf votes the shares on some matters but not others. We will treat broker non-votes as shares present and voting for quorum purposes and votes not cast in any non-routine matter, including proposals 1 2 and 3.

Abstentions, broker non-votes and withheld votes will have no effect on the outcome of the votes on proposals 1 2 and 32 assuming that a quorum is obtained.

If you sign and return your proxy card without giving specific voting instructions, your shares will be voted as recommended by our board.

2 | | Capstead |

GENERAL INFORMATION ABOUT VOTING |

You must meet the same deadline when revoking your proxy as when voting your proxy. See the “Voting” section of this proxy statement for more information. If you hold shares of our common stock in your own name as a holder of record, you may revoke your proxy instructions through any of the following methods:

by notifying our secretary in writing of your revocation before your shares have been voted;

by signing, dating and mailing a new proxy card to Wells Fargo;our secretary;

• | by calling our proxy tabulator at (866) 256-1193 and following the prompts; |

via the internet by logging on to www.eproxy.com/www.proxypush.com/cmo and following the prompts; or

by attending our annual meeting with your proxy and voting your shares in person.

If your shares are held on your behalf by a broker, bank or other nominee, you must contact them to receive information on revoking your proxy.

Notice of Electronic Availability of Proxy Materials

receive a hard copy of the proxy materials unless you request them. If you would like to receive a hard copy of our proxy materials, follow the instructions on the notice.

SEC rules and Maryland corporate law allow for householding, which is the delivery of a single copy of an annual report and proxy statement, or notice of electronic availability, to any household at which two or more stockholders reside, if it is believed the stockholders are members of the same family. Duplicate mailings are eliminated by allowing stockholders to consent to such elimination or through implied consent if a stockholder does not request continuation of duplicate mailings. Depending upon the practices of your broker, bank or other nominee, you may be required to contact them directly to discontinue duplicate mailings to your household. If you wish to revoke your consent to householding, you must contact your broker,

bank or other nominee. If you hold shares of our common stock in your own name as a holder of record and would like to request householding, please contact our transfer agent, Wells Fargo,EQ Shareowner Services, at (866) 870-3684.

Extra copies of our annual report and proxy statement may be obtained free of charge by sending a request to Capstead Mortgage Corporation, Attention: Stockholder Relations, 8401 North Central Expressway, Suite 800, Dallas, Texas, 75225-4404. You can also obtain copies on our website at www.capstead.com www.capstead.reit or by calling us toll-free at (800) 358-2323, extension 2339.

Capstead | | 3 |

PROPOSAL ONE – ELECTION OF DIRECTORS |

One of the purposes of our annual meeting is to elect eight directors to hold office until the next annual meeting and until their successors have been elected and qualified. In order to understand each nominee’s qualifications to serve as a director, it is important to first review our investment strategy.

We operate as a self-managed mortgage REIT for federal income tax purposes and earn income from investing in a leveraged portfolio of residential adjustable-rate mortgage pass-through securities, consisting almost exclusively of relatively short-duration adjustable-rate mortgage (“ARM”)referred to as ARM securities, issued and guaranteed by government-sponsored enterprises, either Fannie Mae or Freddie Mac, or by an agency of the federal government, Ginnie Mae. Duration is a common measure of market price sensitivity to interest rate movements. A short duration generally indicates less interest rate risk.

Set forth below for each director nominee is the name, age, principal occupation, the date elected or appointed to our board, board committee memberships held, the number of

shares of common stock beneficially held, directorships held with other

Also provided below is a brief discussion of our considerations for recommending each of the nominees for director. For discussion of beneficial ownership, see the “Security Ownership of Management and Certain Beneficial Owners” section of this proxy statement. If any nominee becomes unable to stand for election as a director, an event we do not presently expect, the proxy will be voted for a replacement nominee if our board designates one.

The board recommends a vote FOR all nominees.

John L. (Jack) Bernard* | Age | Shares of common stock beneficially owned: |

Executive Director, Renew Financial | ||

Member: Audit and Governance & Nomination Committees | ||

• | Professional Experience: Mr. Bernard is an executive director and former member of the board of Renew Financial, a private company focused on the development of innovative finance and technology solutions to clean energy since 2008. From 2005 to 2007 Mr. Bernard was managing director of OceanTomo responsible for an intellectual property fund and from 2003 to 2004 was managing director for Coastal Capital responsible for an intellectual property sale/leaseback fund. From 1993 to 2002 Mr. Bernard held senior roles at Dresdner RCM Capital Management including managing mortgage, asset-backed and corporate investments held in domestic institutional portfolios, managing a closed-end fixed-income fund and other global credit investment responsibilities. Mr. Bernard worked at Merrill Lynch, Pierce, Fenner & Smith Incorporated from 1984 to 1993 in the mortgage securities trading division with responsibilities for originating, trading and hedging collateralized mortgage obligations, as well as managing a proprietary position in mortgage derivatives. | |

• | Consideration for Recommendation: Mr. Bernard has extensive experience in capital markets and investment management activities having managed and traded mortgage securities and other fixed-income positions for major investment banking firms. He continues to be involved in these markets and various real estate-related activities on a personal and professional basis. Mr. Bernard serves as a member of our governance & nomination and audit committees. | |